Perplexed about how to find a business tax ID? Don’t fret, I’ve got your back. Whether you’re a small business owner or just a curious individual, knowing how to find a business tax ID can be crucial. Not having the correct tax ID can lead to serious consequences, including fines and legal trouble. In this quick tutorial, I’ll guide you through the steps to easily locate a business tax ID, so you can stay compliant and avoid any potential issues. Let’s get started!

Key Takeaways:

- Understanding the Importance: A business tax ID, also known as an Employer Identification Number (EIN), is essential for businesses to conduct tax-related activities and open business bank accounts.

- Check Relevant Government Websites: The Internal Revenue Service (IRS) website is the primary source to obtain a business tax ID. Additionally, individual state tax websites may also provide the necessary information and application processes.

- Utilize Online EIN Assistant: The IRS offers an online EIN Assistant tool, which simplifies the application process by guiding you through a series of questions and providing the EIN upon completion.

- Contact the IRS: If online methods are not accessible, contacting the IRS directly or applying via mail is an alternative option to obtain a business tax ID.

- Keep EIN Information Secure: Once you have obtained a business tax ID, it is crucial to securely store the EIN information and ensure it is protected from unauthorized access to prevent potential identity theft or fraud.

What is a Business Tax ID

Your Business Tax ID, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify your business entity. It is used for tax purposes, similar to how a Social Security Number is used for individuals.

Importance of a Business Tax ID

Having a Business Tax ID is crucial for various reasons. Firstly, it is required for businesses that have employees, operate as a corporation or partnership, or file tax returns for Employment, Excise, or Alcohol, Tobacco, and Firearms. Secondly, it is essential for opening a business bank account, applying for business licenses, and building business credit. Additionally, it helps to protect the personal privacy of business owners by using the EIN for business purposes instead of their Social Security Number.

Types of Business Tax IDs

There are different types of Business Tax IDs, such as the EIN for businesses, the Individual Taxpayer Identification Number (ITIN) for individuals who are required to have a U.S. taxpayer identification number but do not have, and cannot obtain, a Social Security Number (SSN) from the Social Security Administration. Knowing the difference between these tax IDs is essential for ensuring that you apply for the correct one for your business or personal tax needs.

- EIN (Employer Identification Number) – Used by businesses

- ITIN (Individual Taxpayer Identification Number) – Used by individuals who cannot obtain a Social Security Number

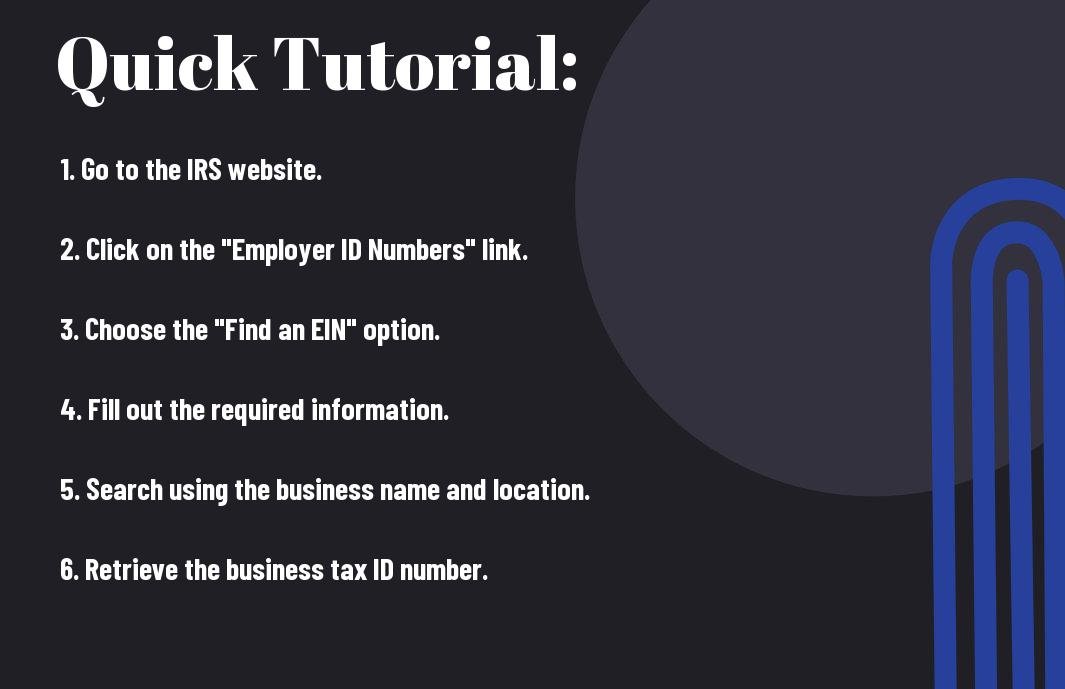

How to Find a Business Tax ID

If you need to find a business tax ID, there are several methods you can use to locate this important information. Whether you are a business owner or an individual looking to do business with a company, knowing the tax ID is crucial for various financial and legal purposes. Here are the quick steps to find a business tax ID.

Step 1: Check Business Documents

If you have done business with the company in the past, you may have received invoices, contracts, or other documents that contain the business tax ID. Check through your records to see if you can locate any of these documents. The tax ID is typically listed on official paperwork related to financial transactions, so it’s worth taking the time to review any relevant materials you may have received.

Step 2: Contact the IRS

If you are unable to locate the business tax ID through your own records, you can contact the Internal Revenue Service (IRS) for assistance. The IRS may be able to provide you with the tax ID, especially if you have a legitimate reason for needing this information. Be prepared to provide as much detail as you can about the company, as this will help the IRS in their search.

Step 3: Use Online Databases

There are several online databases and resources that allow you to search for a business tax ID. These databases may require a small fee for access, but they can be valuable tools for finding the information you need. Use caution when using online databases, and ensure that you are using a reputable and legitimate source for your search.

Step 4: Consult a Professional

If all else fails, or if you are uncomfortable conducting the search on your own, consider consulting a professional. An accountant, attorney, or other financial expert may be able to assist you in finding the business tax ID. Their experience and expertise can be invaluable in navigating the process and ensuring that you obtain the correct information.

How Do I Find a Business Tax ID – Quick Steps

Considering all points, I have outlined the quick steps to help you find a business tax ID. By following these steps, you can easily locate the tax ID for any business entity. Whether you are looking to verify a company’s tax ID for a transaction or simply need to find your own, these steps will guide you through the process in an efficient manner. By using online resources and contacting the appropriate agencies, you can confidently locate the business tax ID you need. Remember to always ensure the accuracy of the tax ID before using it for any official purposes.

FAQ

Q: What is a Business Tax ID?

A: A Business Tax ID, also known as an Employer Identification Number (EIN), is a unique nine-digit number assigned by the Internal Revenue Service (IRS) to identify a business entity for tax purposes.

Q: Why do I need a Business Tax ID?

A: A Business Tax ID is required for several reasons, including opening a business bank account, hiring employees, filing tax returns, and applying for business licenses and permits.

Q: How do I find my Business Tax ID?

A: You can find your Business Tax ID (EIN) on the confirmation letter you received from the IRS when you applied for it. You can also check any previous tax returns or documents filed with the IRS to locate your EIN.

Q: What if I can’t find my Business Tax ID?

A: If you can’t locate your Business Tax ID, you can contact the IRS Business & Specialty Tax Line at 1-800-829-4933. You will need to provide specific information about your business to verify your identity before they can provide your EIN over the phone.

Q: Can I apply for a new Business Tax ID?

A: If you are unable to locate your Business Tax ID or if your business structure has changed, you can apply for a new EIN online through the IRS website. However, it’s important to note that each business entity should only have one EIN, so it’s crucial to exhaust all options for locating the original EIN before applying for a new one.