Peradventure you are a frequent traveler or planning a trip abroad, it is essential to understand the currency transport rules and how much cash you can legally carry. Ignorance of these regulations can lead to confiscation of your funds, hefty fines, or even legal trouble. In this guide, I will provide you with the necessary information to ensure you are in full compliance with the relevant laws and regulations. Whether you are traveling for business or pleasure, it is crucial to be aware of the maximum amount of currency that you can carry without raising suspicion or violating any laws. Additionally, I will highlight some tips and best practices for transporting large sums of cash while minimizing the risk of loss or theft. By the end of this guide, you will have a clear understanding of how to legally carry currency and the potential consequences of failing to adhere to these rules.

Key Takeaways:

- There are no restrictions on how much cash you can carry domestically: In the United States, you can carry any amount of cash domestically without having to report it to authorities.

- Internationally, you must declare amounts over $10,000: When traveling internationally, you are required to declare any amount over $10,000 in cash to customs officials.

- Failure to declare large sums of cash can result in confiscation and legal trouble: If you fail to declare large sums of cash when entering or leaving a country, you risk having the money confiscated and facing legal consequences.

- There are additional restrictions on carrying cash in certain countries: Some countries have specific restrictions on the amount of cash you can carry, regardless of whether you’re entering or leaving the country.

- It’s important to research and understand currency transport rules before traveling: Before traveling with a significant amount of cash, it’s essential to research the currency transport rules of the countries you’ll be visiting to avoid any potential issues.

Types of Currency Transport Rules

The currency transport rules can vary depending on whether you are transporting currency domestically or internationally. It’s important to understand the specific rules and regulations that apply to each type of currency transport to avoid any potential legal issues or complications. Here is a breakdown of the different types of currency transport rules:

| Domestic Transport Rules | International Transport Rules |

Domestic Transport Rules

When it comes to transporting currency within the same country, there are certain rules and regulations that you need to be aware of. Domestic transport rules may differ depending on the country or state you are in. For example, in the United States, there are no limits on how much currency you can carry domestically. However, if you are carrying more than $10,000 in cash, you are required to declare it to the Customs and Border Protection agency.

International Transport Rules

Transporting currency across international borders comes with its own set of rules and regulations. International transport rules are put in place to prevent money laundering, terrorism financing, and other illegal activities. It’s important to be aware of the specific rules of the country you are entering or leaving, as they can vary widely. For example, in many countries, you are required to declare any amount of currency over a certain threshold, typically around $10,000, when crossing borders. Failing to comply with these rules can result in severe penalties, including the confiscation of the currency and legal repercussions.

Tips for Carrying Cash Legally

Clearly, it’s important to understand the rules and regulations surrounding the transport of cash. Here are some tips to help ensure you are carrying cash legally:

- Be aware of the legal limit: Familiarize yourself with the maximum amount of cash you can legally carry in the country you are in or traveling to.

- Declare large sums: If you are carrying a significant amount of cash, it’s best to declare it to the customs authorities to avoid any legal issues.

- Use a secure money belt or pouch: Keep your cash secure and out of sight by using a concealed money belt or pouch.

- Avoid carrying unnecessary amounts: Only carry the cash you need for your immediate expenses to reduce the risk of loss or theft.

- Keep receipts and documentation: Maintain documentation for the source of your cash to prove that it was obtained legally.

After considering these tips, you can ensure that you are legally carrying cash while staying compliant with the regulations in place.

Best Practices for Domestic Carrying

When carrying cash domestically, it’s important to prioritize security and discretion. I recommend keeping your cash in a secure wallet or money belt, and only carrying the amount you need for your immediate expenses. By keeping a low profile and avoiding unnecessary displays of wealth, you can reduce the risk of becoming a target for theft or other criminal activities. Additionally, it’s important to be aware of the legal limit for cash transport within your own country to avoid any issues with law enforcement.

Best Practices for International Travel

When traveling internationally, there are additional considerations to keep in mind when carrying cash. It’s crucial to declare large sums of money to the customs authorities to prevent any misunderstandings or legal complications. I recommend using secure methods of carrying cash such as a concealed money belt or a travel wallet with anti-theft features. It’s also important to be aware of the currency import and export regulations of the countries you are traveling to and from to ensure compliance with their laws.

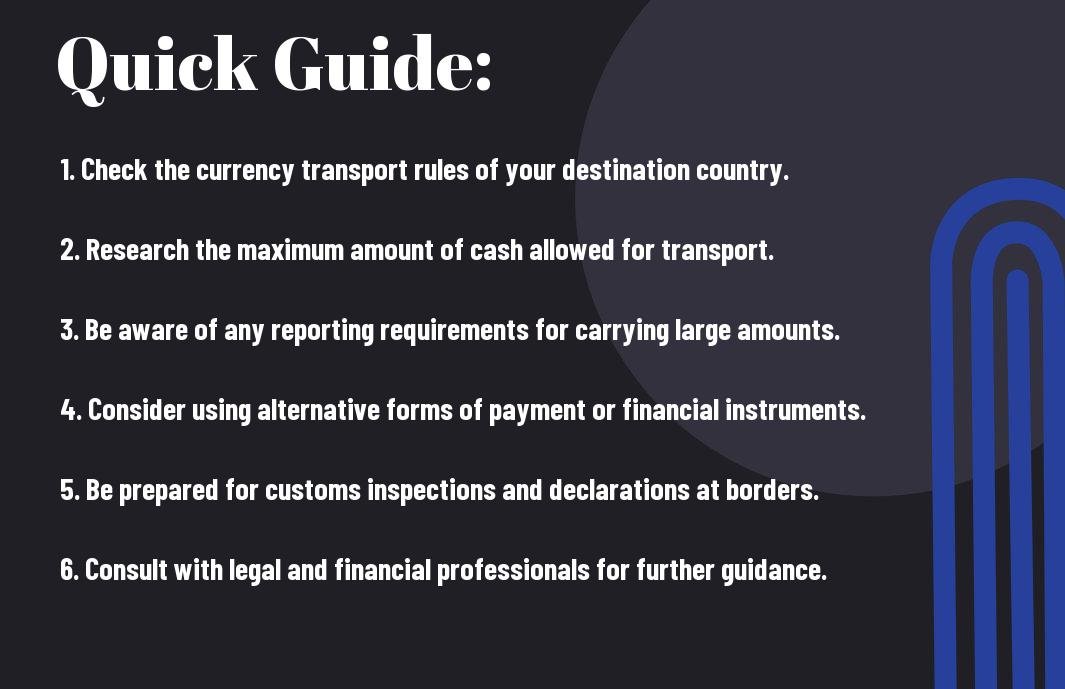

Step-by-Step Guide for Complying with Currency Transport Rules

After researching the currency transport rules of the country you plan to visit, it’s important to prepare for compliance. Below, I provide a practical step-by-step guide to help ensure you comply with currency transport rules.

| Step 1: | Research the currency transport rules of the country you plan to visit |

| Step 2: | Calculate the maximum amount of cash you are allowed to carry |

| Step 3: | Consider alternative forms of transferring money, such as wire transfers or traveler’s checks |

| Step 4: | Prepare to declare the cash at customs, if required |

| Step 5: | Familiarize yourself with the proper way to declare cash at customs |

Preparing for Travel

Before traveling, I recommend researching the currency transport rules of the country you plan to visit. Additionally, calculate the maximum amount of cash you are allowed to carry and consider alternative forms of transferring money. By familiarizing yourself with the rules and regulations, you can avoid potential complications while traveling.

Declaring Cash at Customs

When carrying a large sum of cash, it’s important to be prepared to declare it at customs, if required. I advise familiarizing yourself with the proper way to declare cash at customs to ensure compliance with the currency transport rules of the destination country. Failure to declare cash at customs can result in confiscation and legal consequences.

Factors to Consider When Carrying Large Amounts of Cash

Unlike carrying a small amount of cash, carrying a large sum of money requires more thought and planning. Here are some factors to consider when carrying large amounts of cash:

- The risk of theft or loss increases

- Transporting large amounts of cash can attract unwanted attention

- Legal restrictions and reporting requirements may apply

Perceiving these factors can help you make a more informed decision about carrying cash and take necessary precautions to mitigate any potential risks.

Security Concerns

When carrying a large amount of cash, security is a major concern. Large sums of money are attractive to potential thieves, and the risk of theft or loss increases significantly. It is important to consider the safest way to carry cash and take precautions such as using a secure money belt, keeping a low profile, and being vigilant of your surroundings.

Legal Implications

There are legal implications to consider when carrying large amounts of cash. In some countries, there are reporting requirements for transporting large sums of money across borders. You may be required to declare the amount of cash you are carrying to customs officials, and failure to comply with these regulations could result in legal consequences. It is important to familiarize yourself with the currency transport rules of the country you are traveling to or through to ensure compliance with legal requirements.

Pros and Cons of Carrying Cash vs. Using Other Payment Methods

Keep in mind that there are pros and cons to both carrying cash and using other payment methods. It’s important to weigh these factors before deciding how much cash to carry while traveling.

| Advantages of Cash | Disadvantages of Cash |

| You have immediate access to funds without relying on ATMs or card machines, which can be especially useful in remote areas. | Carrying large amounts of cash can be risky and make you a target for theft. |

| Cash transactions are usually faster than using a card, especially for small purchases. | If you lose cash, it’s gone for good, whereas you can usually cancel a lost card and get a replacement. |

| Using cash can help you stick to a budget and avoid overspending, as you can only spend what you have. | Large amounts of cash may need to be declared at customs when traveling internationally, which can be a hassle. |

| Cash is widely accepted in most places around the world, eliminating the need for a specific type of card or dealing with foreign transaction fees. | Carrying large amounts of cash can be physically burdensome, especially if you’re traveling for an extended period. |

Advantages of Cash

Carrying cash can provide a sense of security and control over your spending. It allows you to have immediate access to funds without the need for ATMs or card machines in areas where they may be scarce. Cash transactions are also usually faster, especially for small purchases, saving you time and hassle.

Disadvantages of Cash

While cash has its advantages, there are also drawbacks to consider. Carrying large amounts of cash can make you a target for theft, and if you lose it, the money is gone for good. Additionally, dealing with large amounts of cash can be physically burdensome, and it may need to be declared at customs when traveling internationally, which can be a hassle.

Conclusively

Understanding currency transport rules is essential to avoid penalties or confiscation when traveling with large amounts of cash. As I have highlighted in this article, the legal limit for carrying cash varies greatly from country to country, and even within the same country, the laws may differ depending on the method of transport. It is your responsibility to familiarize yourself with the regulations before embarking on a journey to ensure that you comply with the applicable rules. In addition, it is advisable to declare any cash amounts exceeding the legal limit to customs authorities to avoid potential trouble. By staying informed and abiding by the law, you can safely transport large sums of cash without encountering legal issues.

FAQ

Q: How much cash can I legally carry when traveling?

A: There is no limit to how much cash you can carry while traveling domestically or internationally. However, if you are carrying more than $10,000 in cash or its equivalent in other currencies, you must declare it to customs upon arrival or departure from the United States.

Q: What are the consequences of not declaring large amounts of cash when traveling?

A: Failing to declare an amount over $10,000 in cash or its equivalent can result in the seizure of the undeclared currency and potential civil or criminal penalties.

Q: Are there any restrictions on carrying cash when traveling internationally?

A: Some countries have restrictions on the amount of cash you can bring in or take out. It’s important to check the currency transport rules of the specific country you are visiting to avoid any issues at customs.

Q: Can I carry large amounts of cash on domestic flights?

A: Yes, there are no restrictions on carrying large amounts of cash on domestic flights within the United States. However, it’s always a good idea to take necessary precautions to safeguard your money while traveling.

Q: Are there safer alternatives to carrying large amounts of cash while traveling?

A: Yes, there are safer alternatives such as traveler’s checks, prepaid cards, and wire transfers that can eliminate the risk of carrying large sums of cash. It’s wise to consider these options for added security and convenience. Always consult with a financial advisor for guidance on the best method for your specific situation.