Gaining a tax residency certificate is crucial for global citizens who want to establish residency in a new country or benefit from favorable tax regulations. In this comprehensive guide, I will outline the essential steps you need to take in order to secure your tax residency certificate and ensure compliance with local tax authorities. From understanding the eligibility requirements to preparing the necessary documentation, I will walk you through the entire process, empowering you to navigate the complexities of international tax law and confidently establish your tax residency status. Don’t risk facing penalties or legal issues – follow these proven steps to obtain your tax residency certificate with ease.

Key Takeaways:

- Understanding Tax Residency: Before applying for a tax residency certificate, it’s essential to understand what tax residency means and its implications for global citizens.

- Research Different Jurisdictions: Look into different jurisdictions and their tax residency requirements to find the one that best fits your financial situation and lifestyle.

- Organize Necessary Documentation: Gather all necessary documentation, such as proof of address, bank statements, and employment contracts, to support your application for a tax residency certificate.

- Seek Professional Assistance: Consider seeking the guidance of tax professionals or legal experts who specialize in international tax issues to ensure your application is thorough and accurate.

- Stay Informed About Tax Laws: Keep yourself updated with the latest tax laws and regulations in your chosen jurisdiction to avoid any compliance issues in the future.

Understanding Tax Residency

As a global citizen, it’s essential to understand the concept of tax residency and how it applies to you. Tax residency is the basis on which a country determines the tax treatment of an individual or a company. It determines where you are subject to tax on your worldwide income, and it is crucial for individuals and businesses operating across borders. Understanding tax residency is the first step in obtaining a Tax Residency Certificate.

What is a Tax Residency Certificate?

A Tax Residency Certificate is an official document issued by the tax authorities of a particular country that certifies individuals or entities as residents for tax purposes. This document is essential for claiming benefits under double taxation avoidance agreements (DTAA) between countries. It serves as proof of your tax residency status in a particular country and is often required by financial institutions and other businesses when opening bank accounts, applying for loans, or conducting international financial transactions.

Why Do Global Citizens Need It?

As a global citizen, obtaining a Tax Residency Certificate is crucial for several reasons. First and foremost, it is essential for avoiding double taxation on your income. Without a Tax Residency Certificate, you may be subject to paying taxes on the same income in more than one country. Secondly, having a Tax Residency Certificate can also open doors to various tax benefits and exemptions provided under international tax treaties. Additionally, it enhances your credibility and facilitates smoother financial transactions, especially when dealing with foreign banks and financial institutions.

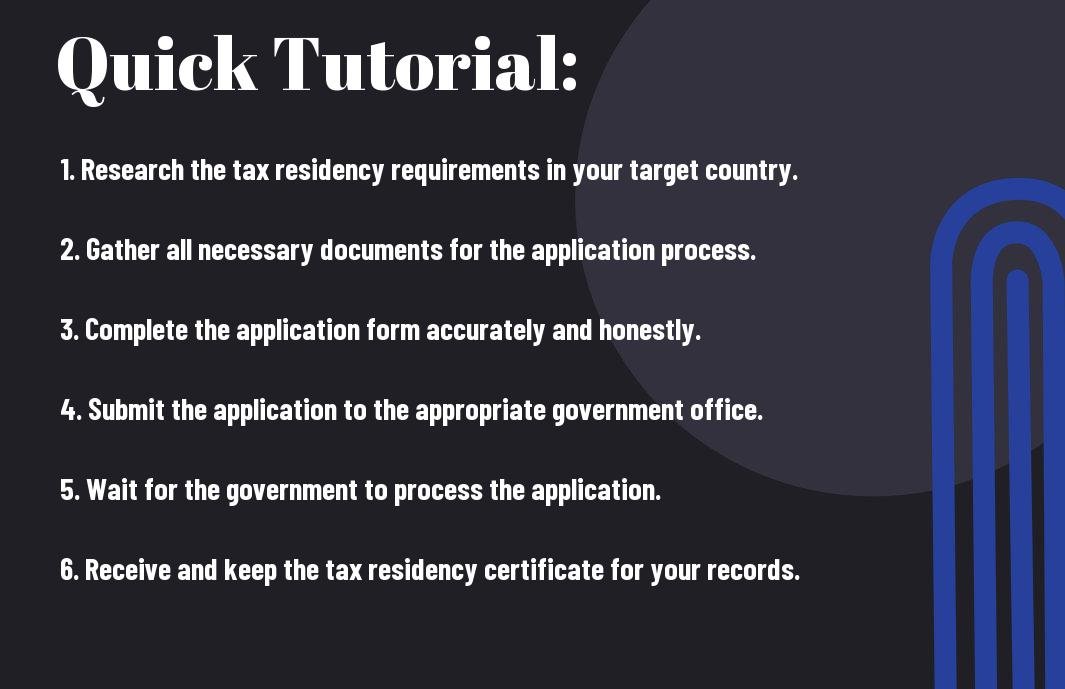

Essential Steps for Obtaining a Tax Residency Certificate

Assuming you have decided to apply for a tax residency certificate, there are several essential steps that you will need to follow in order to successfully obtain one. It is crucial to thoroughly research the requirements, gather the necessary documents, fill out the application accurately, and submit it in a timely manner.

Researching the Requirements

Before beginning the process of applying for a tax residency certificate, it is important to research the specific requirements of the country in which you are seeking residency. This may include demonstrating a certain number of days spent in the country, providing evidence of financial ties, or proving your intention to make the country your primary place of residence. It is essential to have a clear understanding of these requirements before proceeding with your application.

Gathering Necessary Documents

Once you have a clear understanding of the requirements, the next step is to gather all necessary documents. This may include proof of address, bank statements, employment contracts, and any other documents that demonstrate your ties to the country in which you are seeking tax residency. Ensure that all the documents are accurate, up-to-date, and meet the specific requirements outlined by the tax authorities.

Filling Out the Application

After you have gathered all necessary documents, the next step is to fill out the application for the tax residency certificate. This may involve providing personal information, details of your financial situation, and the reasons for seeking tax residency in the country. Pay careful attention to the instructions and ensure that all information provided is accurate and complete to the best of your knowledge.

Submitting the Application

Once the application is completed, it is time to submit it to the relevant tax authorities. Be mindful of any deadlines or specific submission requirements. Double-check all documents and the application form to ensure that everything is in order before submission. It is also advisable to keep a record of when and how the application was submitted for your own records.

Additional Considerations

Keep in mind that when applying for a Tax Residency Certificate, you may encounter additional considerations that could impact the process. It is important to be aware of these factors in order to successfully secure the documentation you need.

Dealing with Language Barriers

When navigating the process of obtaining a Tax Residency Certificate, you may encounter language barriers, especially if you are dealing with government authorities in a country where English is not widely spoken. In such cases, it is essential to have access to a reliable translator who can accurately convey the necessary information. Make sure to have all your documentation properly translated to avoid any misunderstandings that could potentially jeopardize your application process.

Hiring Professional Assistance

If you find the process of obtaining a Tax Residency Certificate to be overwhelming or confusing, consider hiring professional assistance. A tax adviser or lawyer with experience in international tax matters can provide invaluable guidance and ensure that you are taking the right steps to secure your certificate. Additionally, they can help you navigate any legal or bureaucratic hurdles that may arise, ultimately saving you time and hassle in the long run.

Conclusion

Taking this into account, getting a tax residency certificate is an essential step for global citizens looking to establish tax residency in a new country. By following the necessary steps, such as determining the specific requirements of your desired country, gathering the required documentation, and submitting a thorough application, you can ensure a smooth and successful process. It is important to remember that each country has its own set of rules and regulations, so it’s crucial to do thorough research and seek professional assistance if needed. By obtaining a tax residency certificate, you can enjoy the benefits of being a tax resident in your chosen country, such as access to healthcare, education, and employment opportunities. Overall, taking the time to navigate the process of obtaining a tax residency certificate is well worth the effort for global citizens seeking to establish themselves in a new country.

FAQ

Q: What is a Tax Residency Certificate?

A: A Tax Residency Certificate is a document issued by the tax authorities of a country to certifying an individual as a tax resident of that country for a particular period. This certificate is often required to take advantage of tax benefits under double taxation avoidance agreements (DTAA) between countries.

Q: Who is eligible to obtain a Tax Residency Certificate?

A: Individuals who can demonstrate that they meet the criteria for tax residency in a particular country are eligible to obtain a Tax Residency Certificate. This typically includes individuals who have lived in the country for a certain period or can prove that their economic interests are closely tied to the country in question.

Q: What are the essential steps for obtaining a Tax Residency Certificate as a global citizen?

A: The essential steps for obtaining a Tax Residency Certificate as a global citizen include gathering all necessary documentation to prove tax residency, submitting an application to the tax authorities of the relevant country, attending any required interviews or meetings, and complying with any additional requirements specific to the country in question.

Q: What documents are typically required to obtain a Tax Residency Certificate?

A: The specific documents required may vary by country, but typically include proof of address, proof of income, bank statements, and any relevant tax forms. Additionally, a certificate of tax residence from another country may be required to demonstrate eligibility for benefits under a DTAA.

Q: How long does it take to obtain a Tax Residency Certificate?

A: The timeframe for obtaining a Tax Residency Certificate can vary depending on the country and its specific processes. In general, it can take anywhere from a few weeks to several months to receive the certificate once all required documentation and applications have been submitted.